Welcome to our website.

We know that each customer has specific needs, so we strive to meet those specific needs with a wide array of products, investment tools, mortgages and best of all quality service and individual attention. With our no hassle loan option, just

Today's technology is providing a more productive environment to work in. For example, through our website you can submit a complete on-line, secure loan application or pre-qualify for a home loan, that will close in 21 days or less. You may also evaluate your different financing options by using our interactive calculators and going over various mortgage scenarios.

Here is some more information about Minnesota Housing Assistance:

For information on Down Payment Assistance in Minnesota, click here.

For information on the Minnesota HomeStretch Workshop, click here.

Conventional Loans and First Time Home Loans in Minneapolis, Minnesota

Welcome to the official site of All American Mortgage Lending, Inc. We are a full-service mortgage company based in Minneapolis, Minnesota. We specialize in Conventional 1% Down Payment Loans, for qualified borrowers and First Time Home Loans in Brooklyn Center, Brooklyn Park, Minneapolis, St. Paul, Maple Grove, Champlin, St. Michael, Twin Cities Metro. We also serve the surrounding cities in Hennepin County, Ramsey County, Carver County, and Wright County. Whether you are buying a home or refinancing in any of these zip codes: 55429, 55443, 55430, 55444, 55445, 55411, 55412, 55409, 55408, 55376, 55369, 55109, 55110 etc. we can help you realize your dream of home ownership or save you money when getting your new lower monthly payment loan.

In terms of Purchase Loan programs, we offer the following:

Refinancing? We can help you with that, too!

We offer a wide range of refinancing options, designed to best meet the needs of local borrowers. If you're looking for cash out, or to just get a better rate and term, we can assist you. We offer the following Refinancing Programs:

What makes All American Mortgage Lending, Inc unique is that we offer the following niche programs as well: Down Payment Assistance, All Credit Welcome, Credit Repair, E-sign No Documentation, No Hassle Loans.

Contact All American Mortgage Lending, Inc today to discuss your mortgage loan options, and find out which loan program will best suit your needs.

Recent Articles

06

2026

You’ve probably had the same checking account since you were sixteen. Your bank knows your name. Your debit card works everywhere. Loyalty feels safe. But when it comes to a mortgage, that “loyalty” can quietly turn into a convenience fee—and sometimes, a...

28

2026

When most homeowners hear the word refinance, they immediately think one thing: getting a lower interest rate. While that can certainly be part of the picture, it’s far from the whole story. In reality, refinancing is less about chasing rates and more about using your mortgage as a...

19

2026

If you’ve been waiting for the right moment to buy a home, this could be the sign you’ve been looking for. Mortgage rates have recently dropped to their lowest level in nearly three years, creating a rare window of opportunity for homebuyers. After a long stretch of higher...

12

2026

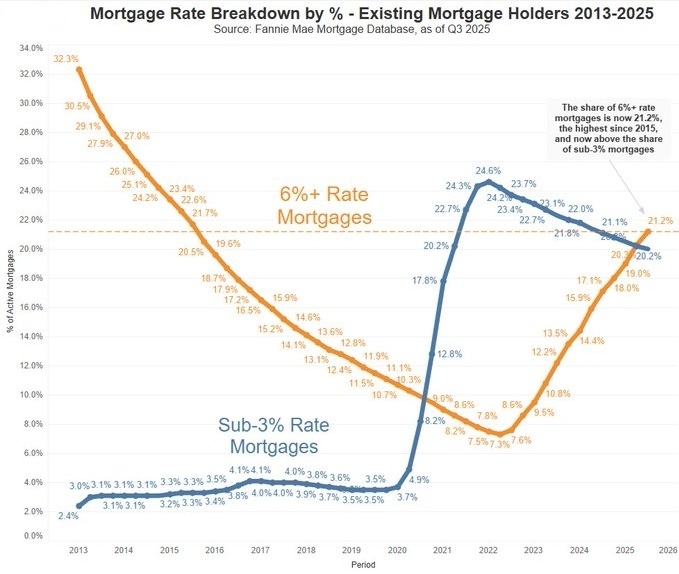

For the past few years, one phrase has dominated housing market conversations: the mortgage rate lock-in effect. Millions of homeowners secured ultra-low mortgage rates below 3% during the pandemic, creating a powerful disincentive to sell. Why give up a once-in-a-lifetime rate and...